The Great Indian Sell-Off: Foreign Investors Pull $12.8 Billion in a High-Stakes Valuation Game

- Editor

- August 26, 2025

- Economy, Stocks Market

- FII, Foreign Institutional Investors, stock market

- 0 Comments

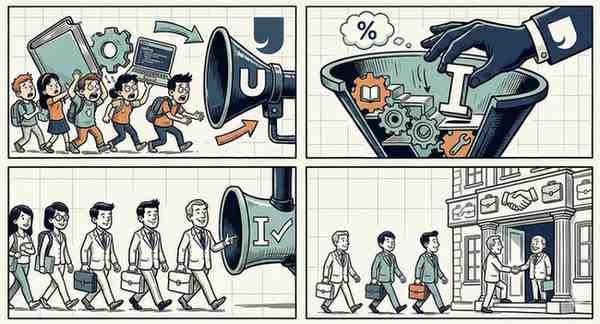

New Delhi, August 2025 — A chill has descended upon the Indian stock market as Foreign Institutional Investors (FIIs) have staged a massive retreat, pulling an eye-watering $12.8 billion from Indian equities in 2025. This capital exodus, now flowing into East Asian markets like South Korea, Taiwan, and China, signals a critical reassessment of India’s risk-reward profile by global finance.

The Valuation Paradox

The sell-off isn’t a verdict on India’s economic health—which remains robust—but rather on its market price. The core of the issue lies in valuations:

- Pricey Premiums: The Indian market is trading at a Price-to-Earnings (P/E) ratio of 19.4x, significantly higher than its long-term average of 17.1x. For global fund managers, this signals that Indian stocks are overvalued, and the potential for near-term gains is limited compared to other markets.

- The Global Shopping Cart: With capital being fluid, FIIs are simply shifting their investments to markets that promise a better bang for their buck. While India’s Return on Equity (ROE) is a healthy 14.4%, the high entry price is proving to be a deterrent.

Government Re-calibrates its Economic Compass

Seemingly in response to the need for more granular economic data, the government is overhauling how it measures inflation. In a forward-thinking move, the Ministry of Statistics will now tap directly into real-time data from e-commerce titans like Amazon and Flipkart.

By tracking price movements based on actual consumer purchasing habits, the government aims to get a far more accurate and immediate read on inflation, allowing for smarter, more responsive policy decisions in a volatile economic climate.

Bottom Line

The FII pullback is a classic case of global capital chasing value. It serves as a crucial market correction, reminding stakeholders that even a strong economy can become too expensive. The government’s pivot to real-time data analytics is a strategic counter-move, showcasing an administration adapting its tools to better navigate the complexities of the modern digital economy and maintain investor confidence.