CPI Turns the Corner: Why India’s Inflation Story Re-entered the Room Before 2026

Key highlights

- Headline CPI inflation moved to 0.10% (provisional) in Nov 2025, from -0.25% in Oct 2025—a narrative shift markets and households notice. Stats & Programme Ministry

- Urban headline inflation rose to 1.40% (provisional) in Nov, up from 0.88% in Oct—often where rent/services pressure shows first. Stats & Programme Ministry

- Food can ease while the rest bites—this divergence is why “inflation is low” can still feel expensive. Stats & Programme Ministry

The November CPI print does not scream crisis—but it does quietly revoke complacency. After October’s negative headline inflation, November’s return to 0.10% (provisional) resets the mental model for 2026: prices may not be “done” with us. Stats & Programme Ministry In editorial terms, this is the moment when the national conversation shifts from celebrating moderation to re-checking assumptions—especially for discretionary spending and everyday pricing.

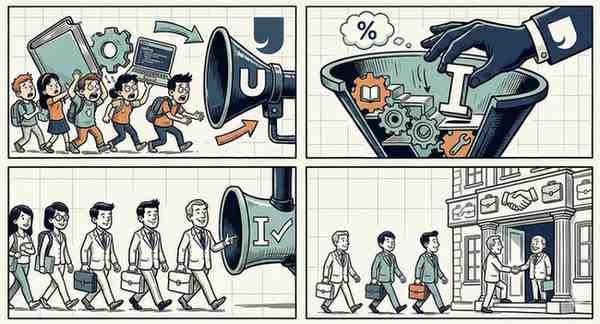

For households, the relevance is brutally practical. A mild uptick can still alter behaviour: the decision to postpone a phone upgrade, the willingness to pay a premium for convenience, the tolerance for “new menu prices.” Inflation is not only an economic variable; it’s a confidence variable. When the headline moves from negative to positive, it signals that bargains may stop expanding and “normal” pricing may return.

For businesses, CPI becomes a shield and a compass at once. It can justify cautious price actions, but it can also warn against overreach—because customers are sensitive after festive spending. The November release’s urban move—1.40% (provisional)—matters here: urban consumers face more services exposure, and that’s where inflation can feel persistent even when some food items soften. Stats & Programme Ministry

The clean takeaway going into January 2026: treat CPI as a map of pressures, not a verdict. The story is not “inflation is back.” The story is “inflation is uneven”—and that unevenness is what determines whether households tighten belts or keep spending.