Banking in India 2026: RBI Signals, NPA Trends, and Credit Growth

- admin

- January 5, 2026

- Banking & Finance, India

- 0 Comments

Key highlights

- Official data shows NPAs have improved sharply in recent years; the watchpoint in 2026 is whether credit quality stays disciplined as loans expand. Press Information Bureau+1

- RBI policy signals hinge on inflation-growth trade-offs; markets read the stance through policy communications (including official releases). Press Information Bureau

- Credit growth is still India’s growth engine, but it can turn into tomorrow’s NPA if underwriting weakens. India Budget+1

- For borrowers, 2026 is about rate sensitivity + documentation discipline: banks are stricter when supervisors are watching. Press Information Bureau+1

NPA trend: the good news (and the trap)

Government-released banking snapshots highlight major improvement in gross NPAs over time (including system-level figures). Press Information Bureau+1 The trap is behavioural: when NPAs fall, lenders can get overconfident and loosen standards—especially in fast-growing segments.

RBI signals: what “policy tone” means in real life

People obsess over one number (repo rate). But RBI signalling is more than the rate: it’s the stance, inflation trajectory, liquidity posture, and forward guidance language. Official summaries of policy decisions and macro assessments give the base narrative markets use. Press Information Bureau

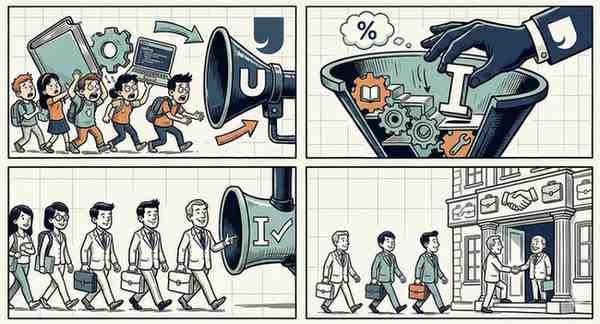

Credit growth in 2026: where it’s likely to push

The Economic Survey’s banking/credit tables and sectoral deployment discussions are the government’s clean, non-hype lens on where credit is flowing. India Budget In 2026, watch three pressure zones:

- Retail unsecured pockets (stress shows up first in delinquencies)

- SME working capital (cash-flow + compliance pressure)

- Real estate-linked exposures (rate sensitivity + project execution risk)

What this means for normal people

- If you’re a borrower: EMI discipline and credit score hygiene matter more in tightening cycles.

- If you’re an SME: banks will ask for cleaner GST, bank statement narratives, and documented cash flows—because supervisory scrutiny punishes weak underwriting. Department of Financial Services+1

Small questions people actually search

- Are NPAs going to rise again in 2026?

They can in specific segments if credit expands too fast. The macro improvement doesn’t immunise every portfolio. Press Information Bureau+1 - How do I read RBI policy without jargon?

Look for: inflation assessment, growth outlook, and the stance—those three drive the “direction of travel.” Press Information Bureau - What’s the smartest borrower behaviour in 2026?

Lock your documentation, reduce unsecured exposure, and keep liquidity buffers—banks price risk faster than you can renegotiate.