AI in Indian Banking: Enhancing Fraud Detection and Risk ManagementHow Artificial Intelligence is Strengthening the Security and Reliability of Banking in India

- admin

- June 16, 2025

- Banking & Finance, India

- Ai, Artificial Intelligence

- 0 Comments

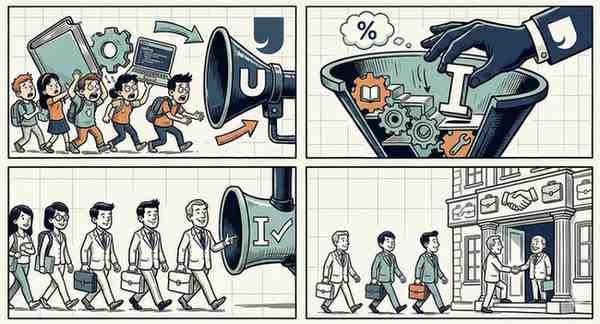

The Indian banking sector, a critical pillar of the country’s economy, faces growing challenges in combating financial fraud and managing risks. With the increasing adoption of digital payments, online banking, and financial technologies, the threat landscape is evolving rapidly. Artificial Intelligence (AI) is stepping up as a game-changer, enabling banks to detect fraud proactively, assess risks accurately, and safeguard customer trust.

The Rising Need for AI in Banking

India is experiencing a surge in digital banking transactions, driven by initiatives like Digital India, UPI, and the widespread adoption of mobile banking. While these advancements improve convenience, they also increase vulnerabilities to cyber threats and fraud.

Key Statistics:

- According to the Reserve Bank of India (RBI), over 9,000 cases of digital banking fraud were reported in 2022 alone.

- The Indian digital payment market is expected to grow at a CAGR of 23% by 2025, necessitating robust security measures.

AI: A Game-Changer in Fraud Detection

AI’s ability to analyze vast amounts of data in real time and identify anomalies is revolutionizing fraud detection in Indian banking.

1. Real-Time Fraud Detection

AI systems monitor transactions in real time, identifying suspicious activities based on patterns, user behavior, and transaction history.

Example:

- State Bank of India (SBI): India’s largest public sector bank uses AI-driven systems to flag unusual transactions and prevent fraud.

Impact:

- Reduced false positives in fraud detection systems.

- Enhanced speed and accuracy in identifying potential threats.

2. Behavioral Analysis for Personalized Security

AI-powered tools analyze customer behavior, such as spending patterns and login locations, to detect deviations that could indicate fraud.

Highlight:

- Banks like HDFC Bank and ICICI Bank employ AI to analyze user behavior for creating dynamic risk profiles, offering tailored fraud prevention measures.

Risk Management: Proactive and Data-Driven

AI is transforming risk management by offering predictive analytics and real-time monitoring, enabling banks to take proactive measures against potential threats.

1. Predictive Analytics for Credit Risk

AI models assess borrower profiles, repayment history, and external economic factors to predict default risks with high accuracy.

Case Study:

- Axis Bank uses AI tools to evaluate loan applicants, ensuring informed lending decisions while minimizing non-performing assets (NPAs).

2. Operational Risk Management

AI systems identify and mitigate risks associated with operational inefficiencies, such as system outages and compliance failures.

Example:

- AI-enabled dashboards provide executives with real-time updates on key risk indicators, enabling quicker decision-making.

AI-Driven Tools in Indian Banking

1. Chatbots and Virtual Assistants:

AI-powered chatbots like Eva (HDFC Bank) and AskSBI (SBI) handle customer queries, reducing workload on human agents while providing instant support.

2. Document Verification Systems:

AI tools verify documents submitted for loans, account openings, and KYC processes, reducing manual errors and preventing identity fraud.

3. Anti-Money Laundering (AML) Solutions:

AI systems analyze transactions to detect and prevent money laundering activities.

Challenges in AI Adoption for Banking

While AI offers transformative potential, its adoption in Indian banking comes with challenges:

1. Data Privacy and Security:

AI systems require vast amounts of data, raising concerns about privacy and the secure handling of sensitive information.

2. High Implementation Costs:

Deploying AI solutions demands significant investment, which may be challenging for smaller banks.

3. Regulatory Compliance:

AI systems must align with RBI guidelines and other regulatory frameworks to ensure ethical and lawful usage.

Government and Industry Support

The Indian government and regulatory bodies are encouraging AI adoption in banking:

- RBI Innovation Hub: Promotes research and development of AI-driven fintech solutions.

- Digital Payment Security Controls: Mandated by RBI to enhance security in digital transactions, encouraging banks to adopt AI tools.

- Partnerships with Tech Companies: Collaborations with firms like IBM and TCS are helping banks integrate AI systems efficiently.

The Future of AI in Indian Banking

AI’s role in Indian banking is set to expand further, with potential developments including:

1. Autonomous Banking:

AI-driven systems may automate end-to-end banking processes, from account management to fraud resolution.

2. Blockchain Integration:

Combining AI with blockchain could enhance transaction transparency and security.

3. Advanced Biometric Security:

AI-powered facial recognition and voice authentication systems will strengthen customer identity verification.

Conclusion

Artificial Intelligence is redefining fraud detection and risk management in Indian banking, enhancing security, operational efficiency, and customer trust. While challenges like data privacy and cost exist, the benefits of AI adoption far outweigh the hurdles.

As Indian banks continue to embrace AI, they are not only safeguarding their operations but also setting new standards for innovation and resilience in the global banking industry. With strategic investments and regulatory support, AI will remain a cornerstone in building a secure and reliable financial ecosystem for India.