Navigating Future Careers in Fintech with an MBA: Opportunities and Pathways

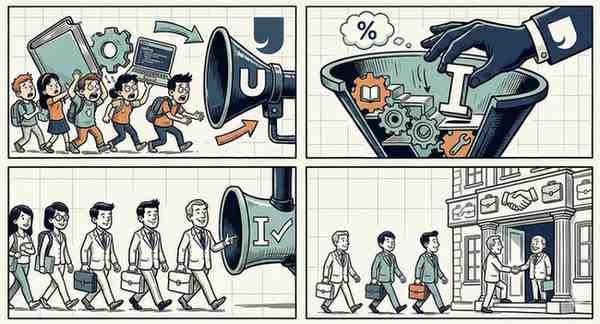

The financial technology (fintech) industry has revolutionized the way people bank, invest, and manage their finances. With advancements in technology driving continuous innovation, the demand for skilled professionals who can bridge the gap between finance and technology is soaring. An MBA with a specialization in fintech or a strong focus on financial technologies can prepare graduates for a range of exciting career opportunities in this dynamic sector.

Here’s a closer look at the future career paths available in fintech for MBA graduates, highlighting the skills required and the potential roles they might undertake.

1. Fintech Product Manager

Role Overview: Fintech Product Managers oversee the development and management of financial products and services, typically in digital banking, investment platforms, or personal finance apps. They work at the intersection of tech, user experience, and finance to deliver innovative solutions that meet market needs.

Skills Required:

- Understanding of digital product development cycles.

- Knowledge of user experience design and customer-centric approaches.

- Strong analytical skills to assess market trends and user data.

Potential Employers: Tech firms like Google, traditional banks with digital arms, or dedicated fintech startups such as Square, Robinhood, or Paytm.

2. Blockchain Strategist

Role Overview: Blockchain Strategists explore and implement blockchain technologies to enhance financial services, focusing on areas like secure transactions, smart contracts, and decentralized finance (DeFi). They help companies understand the potential and limitations of blockchain technology.

Skills Required:

- In-depth knowledge of blockchain technology and its applications in finance.

- Strategic thinking to integrate blockchain solutions into traditional financial systems.

- Ability to work with technical teams to guide blockchain development.

Potential Employers: Blockchain startups, financial institutions investing in blockchain applications, or consulting firms advising on blockchain strategies.

3. Data Scientist in Fintech

Role Overview: Data Scientists in fintech use statistical analysis, machine learning, and predictive modeling to solve complex financial problems, such as fraud detection, credit risk analysis, or algorithmic trading.

Skills Required:

- Proficiency in programming languages such as Python or R.

- Strong quantitative skills to analyze large datasets.

- Understanding of machine learning algorithms and their application in finance.

Potential Employers: Fintech firms like ZestFinance, Kabbage, or larger financial institutions like J.P. Morgan and Goldman Sachs that are expanding their fintech departments.

4. Regulatory Compliance Analyst

Role Overview: Regulatory Compliance Analysts ensure that fintech products comply with all laws and regulations. This role is crucial as the regulatory landscape for fintech is complex and rapidly evolving.

Skills Required:

- Deep understanding of financial regulations and standards (such as GDPR, PSD2, or KYC).

- Ability to navigate through regulatory challenges and implement compliance strategies.

- Strong communication skills to liaise with regulatory bodies and internal teams.

Potential Employers: Any fintech company, but especially those in sectors like payments, digital banking, or peer-to-peer lending, where regulatory scrutiny is high.

5. Venture Capitalist Specializing in Fintech

Role Overview: Venture Capitalists (VCs) specializing in fintech invest in and mentor startups developing new financial technologies. They assess the viability of new fintech ventures and manage investment portfolios to foster innovation in the financial sector.

Skills Required:

- Strong financial analysis skills to evaluate startup potentials and risks.

- Networking skills to connect with startups and investors in the fintech ecosystem.

- Strategic decision-making and a keen eye for innovation in the fintech space.

Potential Employers: Venture capital firms with a focus on tech or fintech innovations, or corporate venture arms of major banks and financial institutions.

Conclusion:

The fintech industry offers diverse opportunities for MBA graduates to leverage their skills in finance, technology, and management. Whether you are innovating with new financial products, ensuring secure and compliant financial operations, or investing in the next big fintech startup, the sector promises a challenging yet rewarding career path. As fintech continues to grow, professionals equipped with an MBA and a deep understanding of both technology and finance will be well-positioned to lead and innovate in this exciting field.