Practo: $100M Pre-IPO Round Signals 2026 Listing

BENGALURU, February 25, 2026 — Practo Technologies, India’s long-standing pioneer in digital healthcare, is reportedly in advanced discussions to secure a $100 million to $125 million pre-IPO funding round. The capital infusion is being positioned as the “final bridge” for the 17-year-old startup as it gears up for a public market debut in the second half of 2026. The Financial …

Continue Reading

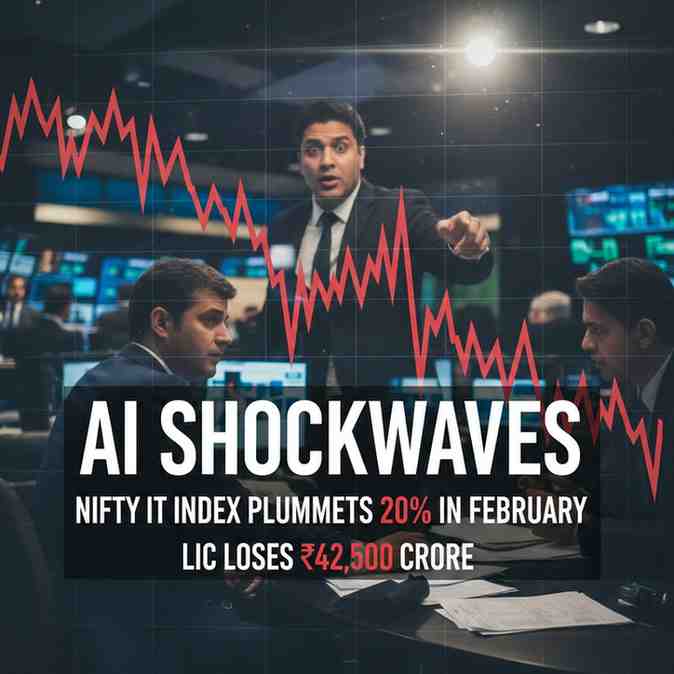

AI Shockwaves: Nifty IT Index Plummets 20% in February; LIC Loses ₹42,500 Crore

Mumbai | February 26, 2026 – The Indian IT sector is grappling with a historic downturn, as the Nifty IT Index recorded a staggering 21% decline in February 2026, marking its worst monthly performance since the 2008 global financial crisis. The sell-off, which saw the index crash by 5% in a single day on February 24, has been fueled by …

Continue Reading

Market Cap Wipeout as ₹590 Crore Fraud Rattles IDFC First

The banking sector faced a localized shockwave this week as IDFC First Bank reported a significant fraudulent event at its Chandigarh branch. The bank disclosed a ₹590 crore discrepancy involving accounts linked to the Haryana Government. Early reports suggest that four employees allegedly engaged in unauthorized fund movements, effectively siphoning off capital that was intended for state development. Economic Fallout …

Continue Reading

RBI Blueprint: ₹5 Lakh Crore Liquidity Injection to Anchor FY27 Debt Market

MUMBAI – In a strategic move to insulate India’s economy from a potential interest rate spike, the Reserve Bank of India (RBI) has outlined a massive ₹5 lakh crore ($60 billion) liquidity injection plan for the 2026-27 financial year (FY27). This proactive intervention is designed to counterbalance a record-breaking ₹40 lakh crore borrowing requirement anticipated from the central government, state …

Continue Reading

IDFC First Bank Shares Plummet 20% Following ₹590 Crore Fraud Disclosure

CHANDIGARH/MUMBAI – Shares of IDFC First Bank witnessed a dramatic 20% crash on Monday, February 23, 2026, hitting the lower circuit after the lender disclosed a massive ₹590 crore fraud at its Chandigarh branch. The incident has wiped out approximately ₹14,400 crore in investor wealth and triggered a swift crackdown by the Haryana state government.+1 The Catalyst: A Mismatch in …

Continue Reading

MARKET ALERT: SCOTUS Detonates $175B Tariff “Time Bomb”; Trump Pivots to 10% Global Surcharge

WASHINGTON D.C. — In a seismic shift for global trade, the U.S. Supreme Court has effectively dismantled the cornerstone of the Trump administration’s trade policy. The 6–3 ruling has not only invalidated existing levies but has also sent shockwaves through corporate balance sheets and international diplomatic circles. I. THE JUDICIAL REBUKE: “Emergency” Powers Overruled On February 20, 2026, the Supreme …

Continue Reading

RBI Reforms: A Civilized Reset for Debt Recovery and Broker Funding

-

Editor

-

February 18, 2026

-

Banking & Finance, Economy

-

0 Comments

New Delhi, February 2026 — In a major regulatory sweep, the Reserve Bank of India (RBI) has issued two significant mandates aimed at ending the “Wild West” era of loan recovery and high-leverage stock market trading. The new directions, part of the Responsible Business Conduct Amendment 2026, focus on restoring borrower dignity and insulating the banking system from capital market …

Continue Reading

Binance vs Coinbase 2026: Who Survives the Regulation Era?

-

admin

-

January 31, 2026

-

Banking & Finance, Business

-

0 Comments

Key highlights What changed the regulatory narrative? For Binance, the U.S. Department of Justice resolution is a hard anchor point in the “regulation era” story. Department of JusticeFor Coinbase, U.S. SEC litigation and subsequent court developments remain central to how U.S. regulation evolves; SEC public releases track these moves. SEC Why does “public-company disclosure” matter in 2026? Coinbase files detailed risk factors, …

Continue Reading

Education Loans 2026: Interest Rates, NBFCs, and Student Risk

-

admin

-

January 28, 2026

-

Banking & Finance, Education

-

0 Comments

Key highlights Interest rates in 2026: what decides what you’ll pay? Rates generally move with: RBI’s education loan information and FAQs are a useful starting point to understand how education loans are broadly structured and what borrowers should look for. UGC+1 Small question people search: Is “low interest” the best education loan?Not always. A slightly higher rate with cleaner repayment flexibility can …

Continue Reading

HSBC 2026: Global bank, fragmented world—how it navigates geopolitics

-

admin

-

January 17, 2026

-

Banking & Finance

-

0 Comments

Key highlights The 2026 question: what does “global” cost now? In a calmer world, “global bank” means distribution. In a fragmented world, “global” means constant renegotiation with regulators, sanctions regimes, and cross-border data rules. HSBC’s annual reporting and investor materials are where it explains how it allocates capital, manages risk, and thinks about geographic concentration. jpmorganchase.com How stability gets priced (the bank …

Continue Reading