Rural demand pulse: how the Survey frames rural consumption and what to watch next

Key highlights

- Agriculture & allied activities contributed ~16% of GDP (FY24, current prices) and supports ~46.1% of the population. India Budget

- Agriculture averaged ~5% annual growth (FY17–FY23). India Budget

- Q2 FY25 agriculture growth: 3.5% (after quarters as low as 0.4% and up to 2.0%). India Budget

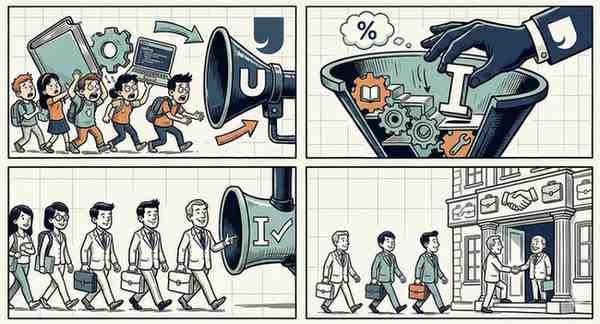

Rural demand is the quiet axis of India’s economy: it doesn’t trend on social media, but it decides what sells—and what stalls. The Survey’s agriculture chapter anchors the rural story with structural weight: agriculture and allied activities contribute about 16% of GDP (FY24, current prices) and support about 46.1% of the population. India Budget That’s not a niche sector. That’s the spine.

It also points to resilience. The sector averaged about 5% annual growth from FY17 to FY23, a sturdier run than many assume. India Budget In Q2 FY25, agriculture growth was 3.5%, a recovery versus the previous four quarters where growth ranged from 0.4% to 2.0%. India Budget

The pessimistic editor’s footnote for 2026 is weather. The chapter highlights climate variability as a persistent risk—and implies that diversification through allied activities (animal husbandry, fisheries, agroforestry) helps farmers absorb shocks. India Budget That matters because rural demand is often less about sentiment and more about rainfall, yields, and post-harvest losses.

So what should readers watch in early 2026?

- Signals of agricultural output stability (because it feeds rural cashflow).

- Price stability in essentials (because rural consumption is more essentials-heavy).

- Whether diversification is scaling beyond policy intent into everyday practice.

A rural demand piece should never be written like a miracle story. It should be written like a risk report—because rural India absorbs the economy’s volatility first.