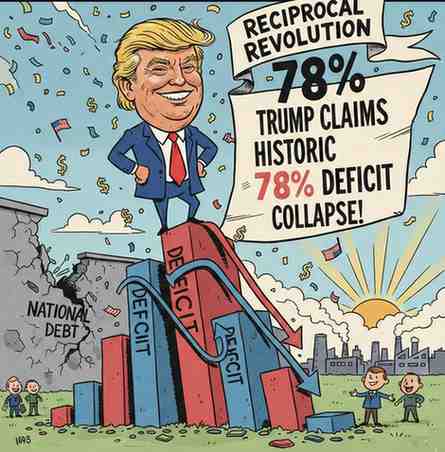

Reciprocal Revolution: Trump Claims Historic 78% Deficit Collapse

- Editor

- February 20, 2026

- Business, Finance, Global Business, Stocks Market

- 0 Comments

WASHINGTON, D.C. — President Donald Trump has declared a “landslide victory” for his protectionist trade agenda, claiming that the U.S. trade deficit has contracted by a staggering 78%.

The announcement, delivered via social media as the administration prepares for official year-end data, marks the most dramatic shift in American trade balance since the mid-1970s. While the President hails this as a “Declaration of Economic Independence,” economists are closely watching a December projection that could see the U.S. post its first monthly trade surplus in over 50 years.

I. The “Liberation Day” Impact: From $140B to $27B

The cornerstone of this shift is the administration’s “Liberation Day” tariffs, a sweeping set of reciprocal duties ranging from 10% to 50% on over 100 countries, enacted in early 2025.

- The Narrowing Gap: Government data shows the monthly goods and services trade deficit plummeted from a record-high $140.5 billion in March 2025 to $27.62 billion in October.

- Surplus on the Horizon: Wall Street analysts are bracing for the December 2025 report, with a consensus forecast of a $55.5 billion surplus. If realized, it would be the first positive monthly balance of trade since 1975.

- Fiscal Windfall: The U.S. Treasury reported that year-to-date tariff revenues reached $124 billion as of January 2026—a massive 304% increase over the previous fiscal period.

II. Strategic Volatility: The Stockpiling “Whiplash”

While the 78% reduction is a headline-grabbing win for the White House, the journey has been marked by intense market turbulence.

- The Q1 Surge: The massive $140 billion deficit in March was largely artificial, driven by American companies “front-running” the tariffs. Importers stockpiled everything from semiconductors to sneakers before the April duties kicked in.

- The November Rebound: Proving the volatility of the new system, the deficit surged back to $56.8 billion in November—a 95% jump from the October low—as export demand softened and imports began a slow climb.

- The China Factor: While the goods deficit with China narrowed by 30% in 2025, trade gaps with allies like Mexico, Vietnam, and Taiwan hit record highs as supply chains rerouted to avoid “made in China” levies.

III. Sector Breakdown: The Services Engine

The administration’s trade balance is essentially a tale of two balance sheets. While the President focuses on manufacturing, it is the American Services Sector that is doing the heavy lifting.

Business Perspective: Despite the rhetoric, the Goods Deficit actually hit an all-time high of $1.24 trillion in 2025. The overall “reduction” was saved by a record-breaking performance in services (software, finance, and tourism) and the sharp appreciation of the dollar, which made foreign debt more expensive and tempered some import volumes.

IV. The Indonesia Deal: A Template for 2026?

As the administration looks to turn 2026 into a year of “Sovereign Surplus,” it is moving away from blanket tariffs toward Bilateral Reciprocal Agreements.

A landmark deal with Indonesia is being finalized this week in Washington. Under the terms, Indonesia’s 32% tariff threat was reduced to 19% after Jakarta agreed to:

- Zero tariffs on all U.S. manufactured goods.

- Preferential access for the U.S. to critical minerals (Nickel and Copper).

- A commitment to utilize U.S.-based AI infrastructure for their domestic digital transformation.

The Bottom Line

President Trump’s trade strategy has successfully weaponized access to the American consumer market to extract bilateral concessions. However, with nearly 90% of tariff costs still being absorbed by domestic businesses, the long-term sustainability of the “October Miracle” remains the central debate in Washington.