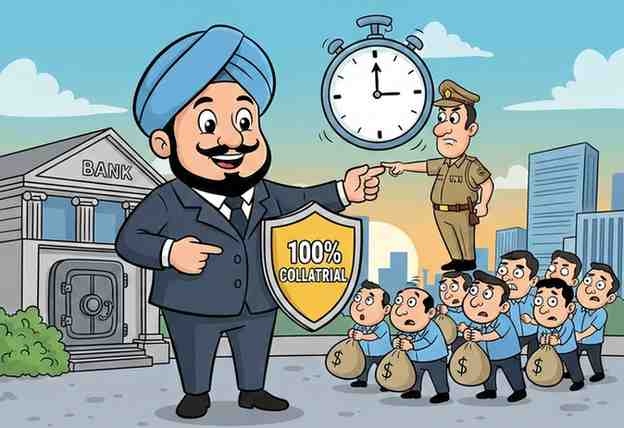

RBI Ends ‘Gunda Raj’: 100% Collateral for Brokers and Strict 7 PM Curfew for Recovery Agents

Mumbai, February 16, 2026 — In a major regulatory sweep, the Reserve Bank of India (RBI) has issued two significant sets of directives aimed at safeguarding the banking system from stock market volatility and protecting citizens from aggressive debt recovery tactics.

The new rules, introduced as part of the Responsible Business Conduct Amendment (2026) and the Credit Facilities Amendment Directions (2026), signal the central bank’s toughest stance yet on institutional risk and consumer privacy.

1. Broker Funding: The End of Unsecured Leverage

To prevent a “domino effect” where stock market crashes could cripple commercial banks, the RBI has mandated that all credit extended to stockbrokers must now be 100% secured.

Key Changes in Broker Lending:

- Mandatory 100% Collateral: Banks are prohibited from extending unsecured loans or partial guarantees to SEBI-regulated brokers. Every rupee of credit must be backed by high-quality collateral such as cash, government securities, or immovable property.

- Haircuts on Equity: If a broker uses equity shares as collateral, banks must apply a minimum 40% haircut to the valuation to account for market fluctuations.

- No Prop-Trading Funding: Banks are now explicitly barred from funding the “proprietary trading” (trading with their own money) activities of brokers. Funding is restricted solely to market-making and client-related margin trading.

- The “Safety Net” Logic: By removing unsecured leverage, the RBI ensures that if a brokerage firm collapses due to risky trades, the lending bank remains fully protected by tangible assets.

2. Debt Recovery: A Digital “Curfew” and Privacy Shield

Addressing years of complaints regarding “harsh recovery practices,” the RBI has released a detailed code of conduct for recovery agents. These rules aim to restore dignity to borrowers and are set to take effect from July 1, 2026.

The New Recovery Rules:

- Strict Calling Hours: Recovery agents are now strictly prohibited from calling or visiting borrowers before 8:00 AM or after 7:00 PM.

- Privacy and Relatives: In a landmark move, the RBI has banned agents from contacting a borrower’s relatives, friends, or colleagues. Interactions must be limited strictly to the borrower or the guarantor.

- Ban on “Social Shaming”: The directives explicitly forbid threatening language, anonymous calls, and inappropriate messages via mobile or social media. Publicly humiliating a borrower or invading their privacy is now classified as a “harsh method” punishable by heavy fines on the bank.

- Occasion Sensitivity: Agents are directed to avoid recovery attempts during sensitive times such as family deaths, marriages, or major festivals.

- Mandatory Recording: All recovery calls must now be recorded and documented, with the borrower being informed of the recording at the start of the conversation.

3. Accountability: Banks Held Responsible

Perhaps the most significant shift is that the RBI will no longer allow banks to “outsource” their reputation.

- Board-Approved Policies: Every bank must have a formal, board-approved policy for recovery.

- Grievance Halt: If a borrower files a formal complaint regarding harassment, the bank must stop all recovery proceedings until the grievance is officially resolved.

- Certification Requirement: All recovery agents must now undergo mandatory training and receive certification from the Indian Institute of Banking and Finance (IIBF).

Bottom Line

The RBI is sending a clear message: financial stability and human dignity are non-negotiable. While the 100% collateral rule ensures that the stock market’s “high-stakes gambling” doesn’t touch the public’s savings, the recovery guidelines ensure that debt collection doesn’t devolve into harassment. For brokers, the era of easy leverage is over; for borrowers, the era of midnight harassment calls has finally come to an end.