Investing in India: Capitalism as a Catalyst for Change

- admin

- October 29, 2025

- Business, Companies & Industry

- 0 Comments

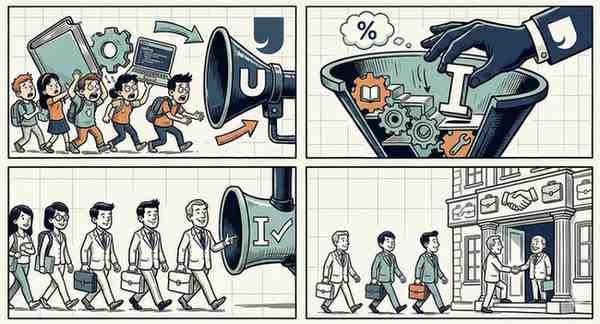

New Delhi, India, 2025 — India, the world’s fifth-largest economy, has emerged as a magnet for global investors, driven by its vibrant capitalist framework and robust market dynamics. With a burgeoning middle class, digital transformation, and government-backed reforms, capitalism is shaping India’s transformation into an economic powerhouse. Investments, both domestic and foreign, are acting as catalysts for change, creating opportunities, fostering innovation, and driving inclusive growth.

This article explores how capitalism fuels investment in India and its impact on the economy and society.

Why India Is an Attractive Investment Destination

1. Rapid Economic Growth

India’s consistent GDP growth has solidified its position as a key global player.

- Fact: India’s GDP grew to $3.73 trillion in 2024, with an annual growth rate of 6.8% (World Bank).

- Impact: This growth creates a fertile ground for investment across sectors, from manufacturing to services.

2. Favorable Demographics

India’s young and skilled workforce is a significant advantage for investors.

- Fact: Over 65% of India’s population is under 35, with over 1 million engineers graduating annually (Ministry of Education, 2024).

- Example: The technology sector alone employs over 5 million people and contributes significantly to exports.

3. Government Reforms and Policies

Pro-business reforms have created an investor-friendly environment.

- Example: The Make in India initiative focuses on boosting manufacturing and reducing import dependency.

- Fact: In 2024, India received $84 billion in FDI, a record high, with technology, renewable energy, and healthcare among the top sectors (Ministry of Commerce and Industry).

Capitalism Driving Sectoral Growth

1. Infrastructure and Urban Development

India’s ambitious infrastructure projects are attracting significant investment.

- Example: The government has allocated ₹10 lakh crore in the Union Budget 2025 for projects like highways, smart cities, and renewable energy parks.

- Impact: These investments improve connectivity, create jobs, and enhance urban living standards.

2. Digital Transformation

India’s digital economy is one of the fastest-growing globally.

- Fact: The digital economy contributed $350 billion to GDP in 2024 and is projected to reach $1 trillion by 2030 (NITI Aayog).

- Example: Investments in fintech companies like Paytm and Razorpay have revolutionized payment systems, boosting financial inclusion.

3. Renewable Energy

India’s commitment to sustainability has opened avenues for green investments.

- Fact: India attracted $15 billion in renewable energy investments in 2024, with solar power leading the way (International Energy Agency).

- Example: Companies like ReNew Power are driving India’s transition to a greener economy.

Challenges for Investors

1. Regulatory Hurdles

While reforms have improved ease of doing business, complex regulations remain a challenge.

- Example: Delayed land acquisition processes often slow infrastructure projects.

2. Infrastructure Gaps in Rural Areas

While urban centers thrive, rural areas require significant development to attract investment.

- Fact: Only 65% of rural areas have reliable internet connectivity, limiting digital growth (Ministry of Rural Development, 2024).

3. Economic Inequality

Wealth disparities pose risks to sustained growth and market expansion.

- Fact: The top 1% of Indians control 40.5% of wealth, while the bottom 50% holds just 3% (Oxfam India, 2023).

Opportunities for Future Investments

1. Expanding Start-Up Ecosystem

India’s start-up boom offers immense opportunities for venture capitalists.

- Example: With over 100 unicorns, India is fostering innovation in fintech, healthtech, and edtech.

2. Focus on Sustainable Development

Investments in green technologies, electric vehicles, and waste management are critical for long-term growth.

3. Strengthening Rural Markets

Developing infrastructure in rural areas can unlock untapped potential, ensuring balanced regional growth.

Conclusion: Capitalism as a Catalyst for Inclusive Growth

Capitalism has played a transformative role in shaping India’s economic landscape. By attracting investments, fostering innovation, and creating jobs, it drives progress across sectors. While challenges like regulatory hurdles and economic inequality persist, India’s commitment to reforms and sustainability ensures a promising future for investors.

With a balanced approach that leverages capitalism for inclusive and sustainable growth, India is poised to remain a global investment hotspot, shaping its path to long-term prosperity.