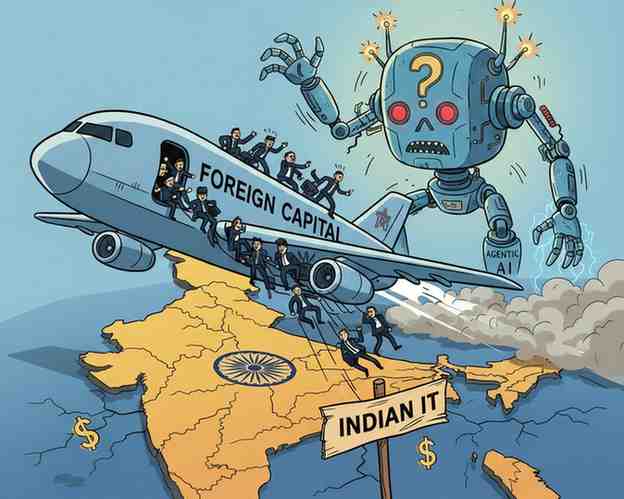

Capital Flight: Foreign Investors Exit Indian IT Amid “Agentic AI” Anxiety

- Editor

- February 20, 2026

- Artifical Intelligance, Business, Capital Journal, Development, Finance, Global Business

- 0 Comments

MUMBAI / SINGAPORE — The Indian technology sector is facing a “structural re-evaluation” as Foreign Institutional Investors (FIIs) accelerate their retreat from the country’s premier software exporters. In a swift February exodus, global funds have pulled approximately ₹11,000 crore ($1.3 billion) out of Indian IT stocks, triggered by fears that the next generation of Artificial Intelligence—specifically Agentic AI—will render traditional service-based business models obsolete.

The sell-off has sent shockwaves through the Dalal Street, contributing to a broader 1.5% market decline as investors rotate capital away from “human-intensive” services toward hardware and AI-native infrastructure.

I. The “Socalypse” Trigger: Anthropic and Agentic Disruption

The catalyst for the current route was a series of software releases from AI firms like Anthropic, whose new automation tools have demonstrated an ability to perform multi-step professional workflows—tasks previously handled by junior engineers at firms like TCS and Infosys.

- The Rise of the AI Agent: Unlike basic chatbots, “Agentic AI” (such as Claude Co-worker) can independently write code, debug systems, and manage legal or financial documentation [03:22].

- Wiping Out Value: The global software sell-off, which erased over $300 billion in market cap in the U.S., has now migrated to Asia, putting India’s ADRs (American Depository Receipts) under intense pressure [00:11].

- Valuation Trap: Traders are increasingly worried that the “Software as a Service” (SaaS) and recurring revenue models that sustained Indian IT for decades are at risk of being decimated by autonomous agents [03:47].

II. Sectoral Carnage: Blue-Chip Bleeding

As the Indian markets opened following the U.S. tech route, the “Big Four” of Indian IT saw immediate and aggressive selling pressure.

| Company | Recent Performance | Market Sentiment |

| Infosys | Down 5% – 6% [34:36] | Investors fear loss of billable hours in core maintenance. |

| TCS | Down 5% – 6% [39:56] | Scaling AI training for 600k+ staff to combat disruption. |

| Wipro | Down 4% [41:20] | High exposure to legacy contracts cited as a risk. |

| HCL Tech | Down 6% [40:05] | Significant pressure on software and platform divisions. |

The “Anti-AI” Trade: Analysts note that India is currently viewed as an “Anti-AI trade” because its listed space has very little exposure to the “hot” AI hardware chain (like chips and servers) compared to Taiwan or Korea [57:31].

III. Defensive Maneuvers: Can the Giants Pivot?

Despite the panic, industry leaders are not standing still. The narrative in Mumbai is shifting from “replacing humans” to “AI Orchestration.”

- Massive Upskilling: TCS is training its entire workforce to use AI, aiming to bring down internal costs and automate routine services to protect margins [56:44].

- Infrastructure Bets: Some firms are moving further up the value stream, investing in “Sovereign AI” hubs and data center capacity to ensure they remain the architects of the new AI economy [13:58].

- Private Market Optimism: Private equity investors argue that the “obsolescence” of these giants won’t happen overnight. They believe many firms will successfully pivot their strategies to integrate AI into their offerings [25:52].

IV. Broader Implications: Rotation and Risk

The exit of ₹11,000 crore isn’t just a tech story—it’s a signal of a broader shift in how global capital views emerging markets.

- Capital Rotation: While IT is bleeding, investors are moving toward more “economically sensitive” sectors and “hard assets” like energy and manufacturing [00:34].

- Geopolitical Cushion: A recently signed trade deal between the U.S. and India is expected to provide some long-term tailwinds, potentially offsetting the immediate technological headwinds [01:08:06].

- The “Wait-and-See” Approach: Institutional investors like GIC and Temasek are reportedly reshuffling their strategies, looking for active managers who can distinguish the AI “winners” from the “losers” in this volatile transition [36:41].

The Bottom Line

The “Agentic AI” scare has forced a reality check on Indian IT valuations. While the sector has survived the cloud and mobile revolutions, the speed of AI automation represents a different kind of threat—one where productivity gains might lead to revenue deflation if firms cannot quickly transition from selling hours to selling intelligence.