SME Cashflow Strategy for 2026: What a Strong GST Month Can Mean (Without Promising a Boom)

- admin

- January 3, 2026

- Business Trends, Economy

- 0 Comments

Key highlights

- Domestic GST reference in the factsheet: ₹1,45,052 crore in Oct 2025. Press Information Bureau

- The GST PDF provides component splits—useful for directional reading, not prophecy. Press Information Bureau

- For SMEs in 2026: turnover can rise while cash tightens (receivables lag).

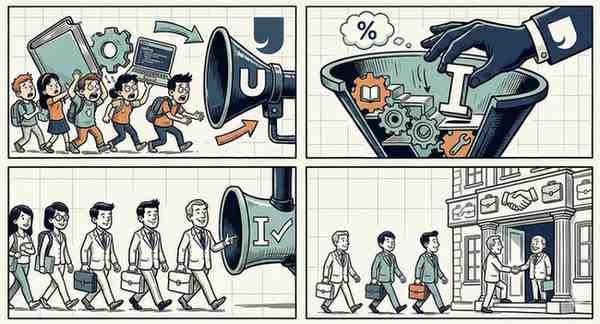

A big GST month is comforting for headlines. For SMEs, it’s more complicated: it can mean more invoices—and more waiting.

The October 2025 release suggests formal activity remained firm, and the factsheet reports domestic gross GST at ₹1,45,052 crore for Oct 2025. Press Information Bureau The PDF shows the tax-component structure, reinforcing that the strength is broad-based across the system. Press Information Bureau

Now bring it into January 2026 reality: SMEs don’t fail from lack of sales; they fail from lack of cash. A festive spike can create an illusion of comfort while receivables stretch. Customers buy, but pay later. Inventory turns, but working capital gets trapped.

So what’s the 2026 takeaway without hype? Treat a strong GST month as a cue to tighten fundamentals: watch debtor days, renegotiate credit cycles, reduce dead stock, and build a small liquidity buffer before the post-festive slowdown tests discipline.

If collections remain firm across multiple months, SMEs can plan with more confidence. If they soften sharply after festivities, the correct response isn’t panic—it’s cash control.

That’s the honest SME lens: GST can hint at demand continuity, but cashflow management decides survival.