Gold vs Equity in 2026: Indian Investor Behaviour Shifts

- admin

- January 11, 2026

- Business Trends

- 0 Comments

Key highlights

- The “safety vs growth” tug-of-war is getting more tactical in 2026, not emotional.

- Gold demand is increasingly “financialised” (SGB/demat/structured products) rather than only jewellery/coins.

- Equity participation is staying broad, but volatility is forcing better discipline (SIPs, diversification, time horizon).

- The real shift is how investors rebalance after shocks: quicker switches, shorter patience.

- Regulators are pushing stronger disclosures and risk communication.

What’s actually changing in 2026?

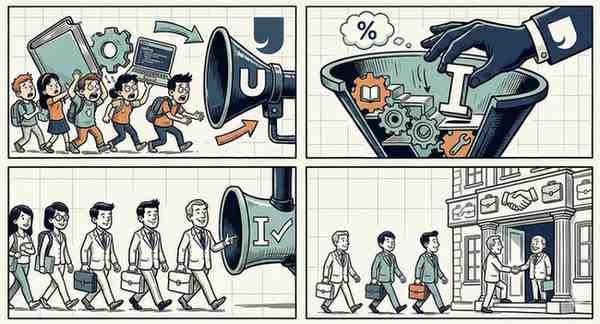

In 2026, Indian households aren’t choosing gold or equity as an identity statement; they’re using both as tools. The post-2020 retail wave made equity familiar, but inflation, global rate cycles, and geopolitical uncertainty have kept gold relevant as a hedge. What’s new is how fast money rotates between perceived “safety” and “growth” depending on headlines and drawdowns.

Why does gold still pull money in?

Gold remains a “trust asset” in India — but increasingly investors prefer forms that reduce storage and purity risks. Sovereign Gold Bonds (SGBs) are explicitly designed as a substitute for holding physical gold, issued by RBI on behalf of GoI and redeemed in cash on maturity. Reserve Bank of India+1

That matters because in a tight cash-flow environment, liquidity + transparency becomes more valuable than tradition alone.

What signals show equity is still dominant for long-term wealth goals?

On the equity side, participation is no longer limited to metro elites; market access is mainstream. Even in late 2025, SEBI’s own published daily trade trend snapshots show mutual funds actively participating in equity markets (gross purchases/sales), reflecting the scale of market-linked household money. Securities and Exchange Board of India

But the retail mindset is maturing: more investors now treat equity as a process (SIP + asset allocation) rather than a “one-time bet.”

Small question people search: “Should I move to gold when markets fall?”

If your goal is long-term wealth creation, panic-switching usually creates regret. A cleaner approach in 2026 is: keep equity for growth, use gold as a hedge, and rebalance on a rule (for example, once a year). Gold can reduce portfolio drawdowns, but it won’t reliably replace equity compounding.

What to watch in 2026

- Product structures: more “gold-like” products packaged as market instruments.

- Risk disclosures: SEBI keeps tightening how products explain risk/strategy. Securities and Exchange Board of India

- Liquidity preference: investors will pay a premium for instruments that can be exited cleanly.