JPMorgan 2026: Why the “fortress balance sheet” matters in unstable markets

- admin

- January 12, 2026

- Banking & Finance

- 0 Comments

Key highlights

- “Fortress balance sheet” is a philosophy: hold enough capital and liquidity to act during stress, not just survive it.

- JPMorgan’s annual report materials lay out how it frames resilience, liquidity, capital, and long-run strategy. jpmorganchase.com

- In unstable markets, optionality is power: the ability to lend, acquire, and invest while others retrench.

- For customers, this can affect credit availability and pricing across cycles.

- For investors, resilience is a compounding engine—if management doesn’t get reckless.

Why the phrase matters in 2026

In 2026, markets punish weak funding models quickly. A fortress balance sheet isn’t marketing poetry; it’s a competitive weapon.

JPMorgan’s own annual report ecosystem (including shareholder letters and management discussion sections) is where the bank communicates this “resilience-first” approach and how it thinks about long-run returns. jpmorganchase.com

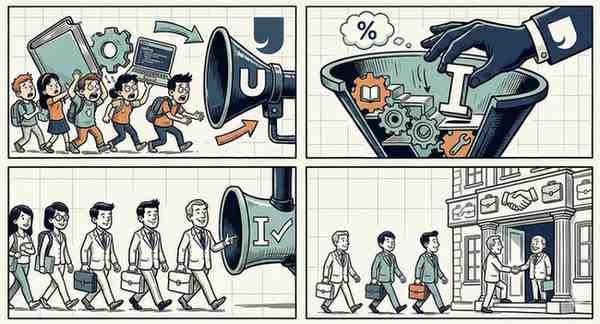

What a fortress balance sheet buys you

1) Staying power

A bank with deep liquidity doesn’t need to sell assets at bad prices to meet obligations.

2) Credit leadership in downturns

When competitors pull back, a strong bank can selectively lend at better terms.

3) Acquisition optionality

Stress creates forced sellers. Optionality lets you buy quality assets—if regulators allow it and integration is disciplined.

4) Client trust

In finance, trust is a deposit. During stress, deposits flow toward perceived safety.

The trade-off nobody advertises

A fortress mindset can also mean:

- more conservative risk appetite

- potential underperformance in euphoric bull markets

- heavy compliance and operational spending

But in a world where shocks are frequent—geopolitical, cyber, commodity—the market often re-rates resilience upward.

What Indian readers should take from this

Even if you don’t bank with JPMorgan, global banks influence:

- cross-border credit conditions

- USD liquidity pricing

- risk sentiment in emerging markets

When a fortress player is confident, global credit tends to flow more smoothly. When fortress players go defensive, everyone feels the chill.

Small questions people search (quick answers)

Is “fortress” just branding?

It’s branding and a balance-sheet policy. The evidence is in capital, liquidity, and risk posture disclosed in annual reporting. jpmorganchase.com

Does it guarantee safety?

No bank is shock-proof. But resilience increases odds of stability under stress.

Why does it matter for 2026 specifically?

Because unstable markets don’t reward optimism; they reward funding strength and disciplined risk.