Bulgaria Adopts the Euro — A Monetary Switch With Political Consequences

Key highlights

- Bulgaria is scheduled to join the euro area on 1 January 2026 with a fixed conversion rate. European Central Bank+1

- Euro adoption reduces currency risk and transaction friction, but domestic politics can complicate implementation. European Central Bank+1

- This is integration—and also exposure: closer alignment with eurozone discipline and scrutiny. European Central Bank

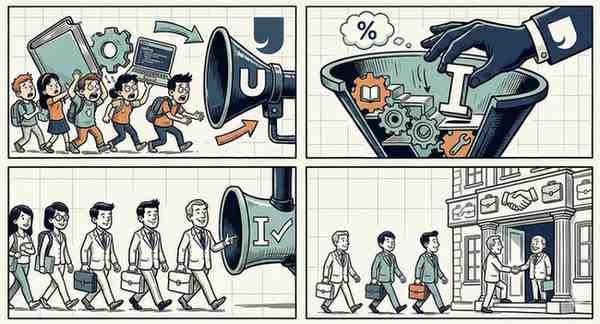

Money is never just money. Bulgaria’s move into the euro area on 1 January 2026 is a historic act of integration that will be sold as stability and modernization—and criticized, inevitably, as surrender of monetary identity. European Central Bank+1

Geopolitically, the euro is a signal: it tightens Bulgaria’s embedding in the EU’s core economic structures. For businesses, it simplifies cross-border pricing and cuts exchange-rate noise. For politics, it can inflame old anxieties: inflation fear, trust in institutions, and the recurring suspicion that ordinary citizens pay the adjustment cost while elites claim the victory. Domestic unrest and political volatility can shape how smooth the changeover feels on the ground. Reuters+1

How things could turn out

- Best case: transition is operationally smooth; confidence rises; Bulgaria gains credibility and lower friction in trade/finance. European Central Bank

- Middle case: technical adoption succeeds, but public sentiment remains split—euro becomes a permanent political talking point.

- Risk case: political instability muddies governance during rollout, feeding distrust even if the monetary mechanics work. Reuters+1

Official source: European Central Bank and euro changeover documentation. European Central Bank+1