The Impact of AI on Financial Services: Transforming Banking in India

- admin

- September 15, 2025

- Banking & Finance, Tech Updates

- 0 Comments

“Smart Banking: How AI is Revolutionizing India’s Financial Landscape”

Key Takeaways:

- AI is reshaping the Indian banking sector by enhancing customer service, streamlining operations, and reducing fraud.

- Major banks are increasingly leveraging AI-driven tools for personalized banking, credit risk analysis, and real-time fraud detection.

- The adoption of AI in financial services is driving cost efficiency and improving customer satisfaction.

What the Numbers Show:

- 87% of Indian banks are using AI in some form, according to a 2023 report by PwC.

- AI-powered chatbots have reduced customer query resolution times by 60%, improving satisfaction rates.

- Fraud detection systems powered by AI have cut financial losses by 30%, according to data from the Reserve Bank of India (RBI).

- The Indian financial AI market is expected to grow at a 22% CAGR, reaching $3 billion by 2026.

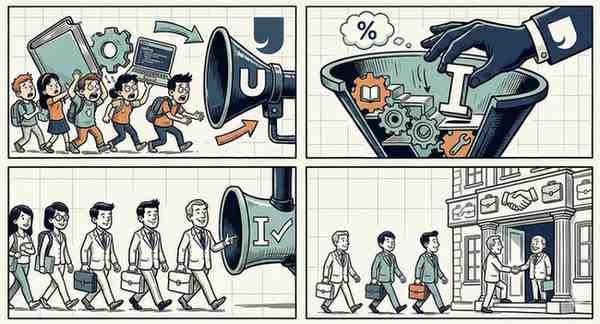

AI-Driven Customer Experience in Banking

AI is redefining customer interactions in banking by offering personalized and efficient service. AI-powered chatbots and virtual assistants, such as HDFC Bank’s Eva and SBI’s YONO, handle millions of queries daily, significantly reducing wait times and enhancing customer satisfaction. These chatbots, which operate 24/7, have been credited with a 60% reduction in query resolution times, as reported by PwC.

Streamlining Credit Risk Analysis

Credit risk analysis is one of the most transformative areas of AI in banking. By analyzing large datasets, including transaction history and market trends, AI algorithms provide faster and more accurate creditworthiness assessments. This has led to a 40% improvement in loan approval turnaround times for Indian banks, enabling quicker access to credit for customers while reducing default rates.

Fraud Detection and Prevention

AI is playing a critical role in combating financial fraud, a significant concern for the banking industry. AI systems use machine learning to detect unusual patterns in real-time, flagging potentially fraudulent activities before they escalate. According to the RBI, banks using AI for fraud detection have reduced financial losses by 30%. For example, ICICI Bank uses AI to monitor and analyze millions of transactions daily, enhancing its fraud prevention capabilities.

AI in Personalized Financial Services

AI is also helping banks tailor their offerings to individual customer needs. By analyzing customer data, AI tools recommend financial products such as loans, credit cards, and investment plans that align with the customer’s financial goals. Kotak Mahindra Bank, for instance, uses AI to provide personalized investment advice, leading to a 20% increase in customer engagement with financial products.

Operational Efficiency Through Automation

Back-office operations have significantly benefited from AI-driven automation. Processes such as compliance checks, data entry, and reconciliation are now handled by AI, reducing human error and cutting operational costs. A study by EY India revealed that AI integration has led to a 25% reduction in operational expenses for Indian banks, contributing to higher profitability.

Challenges and Ethical Concerns

Despite its advantages, the implementation of AI in banking is not without challenges. Data privacy and cybersecurity remain major concerns, as AI systems handle sensitive financial information. Moreover, smaller banks and cooperative institutions often lack the resources to adopt AI technologies, creating a divide between large and small players in the industry.

Future of AI in Indian Banking

The future of AI in Indian financial services is promising. Industry analysts predict that AI will continue to evolve, with innovations in blockchain integration, advanced robo-advisors, and real-time sentiment analysis. By 2030, AI is expected to be fully integrated into all aspects of banking, creating a smarter, more inclusive financial ecosystem.